What is the future of corporate reporting?

“The future of corporate reporting and the role integrated thinking” was the core topic discussed recently at an international event held by the MIB School of Management in Trieste (Italy) thanks to the sponsorship of Assicurazioni Generali. In front of 200 participants, an international panel of relevant speakers shared insights from different perspectives on this strategic topic.

Corporate reporting is experiencing a true revolution when compared to the last couple of decades, thanks to new Frameworks that are applicable on a voluntary basis. During the event, the International Integrated Reporting Framework was highlighted as the most relevant new framework, and one that can support with the new EU regulation – EU Directive on Non-Financial disclosure.

Core and more

Delegates heard from Ben Renier (Accountancy Europe) that ‘Core and More’ reporting is useful to companies struggling to navigate the corporate reporting landscape and provide concise strategic insight (‘core’) into their organisations without missing important detail (‘more’) that is often required by a variety of stakeholders.

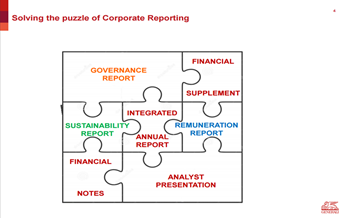

An integrated report can provide a strategic hub (core), explained Sarah Grey (International Integrated Reporting Council), which connects companies’ purpose, strategy and business model with their performance across multiple capitals. This connects (as shown below) with the in-depth information in the financial and governance statements, the sustainability report and other sources.

With only 20% of companies’ market value found in the tangible assets in the financial statements, it is no wonder companies around the world are increasingly using the International <IR> Framework to support integrated thinking and help understanding of the 80% of their market value that is created by ‘pre-financial’ factors, such as intellectual capital, relationships and human capital.

Generali’s ‘Core and More’ Reporting suite

Frontrunners

The Italian market has great practical case studies of the Integrated Reporting principles: Massimo Romano and Lucia Silva (Assicurazioni Generali) and Marco Pasquotti (CFO of the Italian SME Dellas) are some of the Italian “<IR> evangelists”. Both Assicurazioni Generali and Dellas were early adopters of the <IR> Framework. They are some of the Italian Front runners of this reporting evolution and their examples will speed up the effective integration of the information in an annual report, as required by the recent Italian regulation (DLGS 254/16).

See Dellas example here and a Generali example here.

Meeting market needs

The point of view of auditors was given by Andrea Rosignoli (KPMG) while Livia Gasperi (Borsa Italiana) spoke on behalf of the Italian Stock Exchange. Both speakers underlined the importance of enhanced disclosure, which has the twofold beneficial effects of being closer to the stakeholders needs and aligned with what is required from a regulatory standpoint. The external assurance of non-financial information and of integrated reports as a whole is a topic that has to be further analysed but the journey has just begun for the audit community.

Building expertise

Andrea Tracogna (Deputy Dean at MIB) pointed out that academics have also shown a deep interest in recent trends in the world of corporate reporting. Business Schools can play a relevant role in nurturing the Integrated Reporting journey in society as they are ideal meeting points to share best practices. In this context, MIB School of Management decided to apply for and has received the certification from the IIRC to become the first Italian Business School to be an official <IR> Training partner. (Find out more about <IR> Training and events.)

Business benefits

Chiara Mio, Full Professor, Ca’ Foscari Venice University, argued that Integrated Reporting may bring two key beneficial effects for preparers: both a better cost of capital and an improved decision making process. This is confirmed by practical evidence and research, for example with South African companies. The issue of materiality is another relevant topic where there is room for evolving the current practices in order to further improve the capacity to communicate the real value of a company. (See further research here and the Corporate Reporting Dialogue Materiality statement and Landscape Map.)